Post-COVID Aviation Operating Landscape will be Catalyzed by Digital Transformation says ICAO

Post COVID-19, aviation companies require more than existing infrastructure to adapt to new realities. Behind every flight is a carefully orchestrated tech ecosystem that forecasts based on a variety of macro and micro trends: consumer demand (business and personal), industry consolidations, aircraft maintenance regimens, government bailouts, supply chain effectiveness, as well as pilot and Crew Availability.

This multifaceted ecosystem of operations felt a buckle as it hit a trough in April of last year. According to the ICAO’s Economic Impact Analysis, in 2020, global airlines saw a 51% reduction in seats offered, 2,891 to 2,893 million fewer passengers, and approximately 391 billion USD of potential gross revenues lost. “Whether we are talking entirely new technologies, or new applications of existing technologies, digital, AR, and AI solutions are now at hand to permit us to pre-screen passengers and cargo more extensively than ever before, for both health and security risks, and with greater efficiency and less disruption,” says Dr. Liu, ICAO secretary.

The once rigidly implanted information technology systems needing to cope with this cataclysmic shift in demand can take some lessons from existing digital transformations. IT systems including supply chain planning systems, MRO platforms, and demand models are being stressed, tested, and relied upon even more to drive efficient operations, with stifled demand threatening airline cashflow. Behind all of these components is a wealth of data, spurred on by the internet-of-things, which can be analyzed, aggregated, and visualized to make predictions in both planning fleet management and supporting vital operations decision making.

Airlines are faced with the challenge of developing leaner more acutely integrated fleet management solutions that will reduce costs, increase operational efficiency, and produce prognostic insights into maintenance life cycle data. Artificial intelligence and advanced predictive analytics can provide the best solutions to this industry’s current unpredictability. Predicting fleet impacting events and their effect on maintenance, repair, and overhaul readiness with 100% certainty is exceptionally difficult, but that doesn’t mean we can’t get close.

What trends support the need to innovate you may ask?

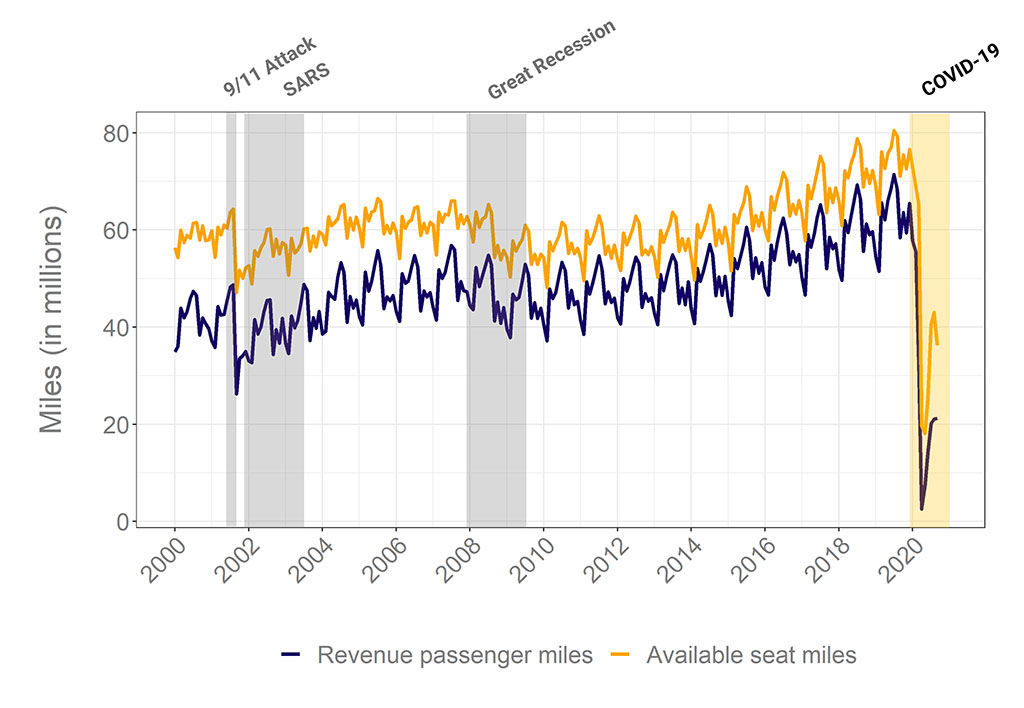

- Jan to Sep of 2020 had 59% lower domestic passenger miles than the same period in 2019, increasing the need to improve operational efficiencies and maintain healthy operating margins. (Data)

- Long-term grounded airplanes will have a significant maintenance burden, with the European Aviation Safety Agency (EASA) reporting an “alarming trend” of aircraft providing incorrect airspeed and altitude readings upon reintroduction.

- Existing initiatives to bring automation to aviation will continue to accelerate to encourage the trend towards new economic and sustainable futures.

The customized data solutions we have successfully implemented in the past for major clients like The Boeing Company including automated algorithms, predictive and preventative maintenance tools, and data visualization, are now more important than ever to help aviation professionals reduce costs and increase efficiency.

Aviation Recovery Strategy

Evaluating data from the past to forecast for the future.

The September 11th attack was a sudden shock with widespread industry and consumer ripple effects concerning safety. The SARS virus held less of an immediate shock but in combination with 9/11, created a short-term plateau of passenger travel. The 2007 – 2009 financial crisis, as seen from the data below, created a prolonged dip in miles traveled with airline passengers. Only when comparing the effect these events had on passenger demand with 2020 can we truly see the monumental impact COVID-19 has had. This virus is a challenging reality we now face, extending its grasp beyond our early expectations and impacting how we work, travel, and live in a profound way.

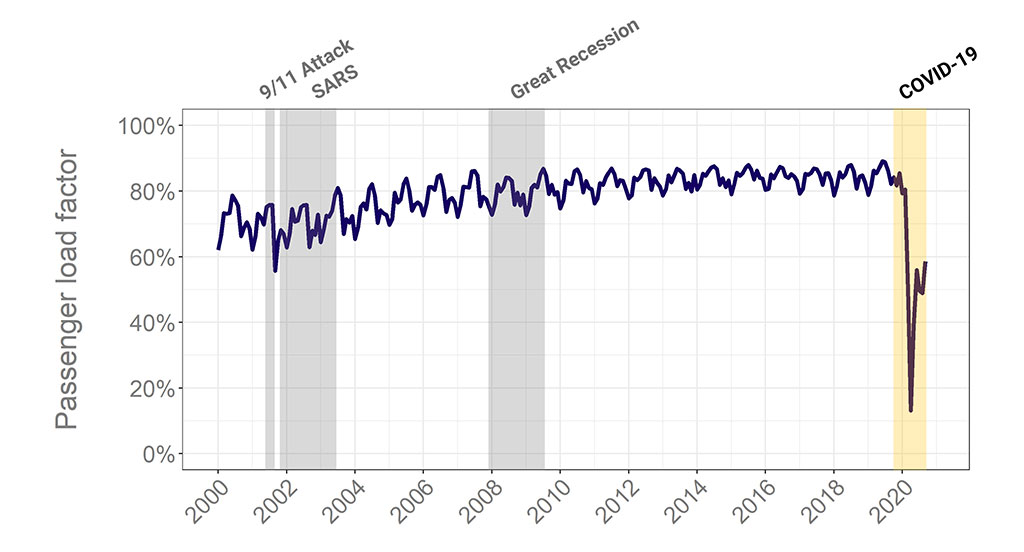

The figure below shows the domestic load factor percentage, in other words: the utilization rate of airlines. Here we can truly see the scale of the impact COVID-19 has had when compared with the extremely limited effect of previous dilemmas. After the initial drop in April 2020, predominately caused by travel lockdowns and extensively spread-out passenger loads, passenger utilization rates began to return significantly in June. This is likely attributable to airlines adopting more optimal flight routes, government approval to use every available seat if proper PPC cleaning guidelines are put in place, and a general return of passenger confidence.

Aircraft sitting in storage require increasing levels of supervision to return to operating status as time goes on. From maintenance errors and out of practice pilots, to nests of insects blocking circuitry and sensors, resuming flight operations will require diligent oversight, and with an already dwindling MRO infrastructure, a deficit for throughput capacity is likely for airlines. Forecasting returning flights efficiently is a significant hurdle to overcome. Post-COVID, airlines would benefit from utilizing AI-driven forecasting tools to help manage the operational challenges of bringing planes back to service. Having the necessary technical expertise to provide these insights is the basis for effective strategic planning.

How Technology can Help the Aviation Industry Recover from Coronavirus

What effective maintenance, repair, and overhaul regimens are prescribed to meet fleet health needs in the current climate? The industry has moved away from unscheduled maintenance and now expects innovation that allows for predictive scheduled maintenance. The adoption of connected devices and sensors empowers aircraft health information sharing, leading to more conclusive maintenance insights. Various data points can be integrated into customized decision support software that allows ground personnel or managers to receive the new insights they require.

These insights can be achieved through effective data modeling, AI, and software integration, and when coupled with predictive analytics, airlines have a far greater understanding of their operations in both the present and future.

Increased passenger volatility and lower industry-wide demand have challenged how airlines utilize their fleet management solutions in 2020 and beyond. COVID-19 has catalyzed a greater need for more forward-thinking fleet management solutions that reduce costs, increase operational efficiency, and produce prognostic insights into maintenance life cycle data. Investing in artificial intelligence and advanced predictive analytics can provide some of the best solutions to this industry’s increasingly unpredictable maintenance and demand schedules.

It’s challenging to stay on top of the digital transformation in aviation and beyond especially now with the impacts of COVID-19, that’s why we’re here to guide you with predictive analytics, data science, and software support tools.

Data Used

1. U.S. Air Carrier Traffic Statistics

2. Employment